The procedure to apply for the SvaNidhi scheme is very easy. To get a loan through an online process follow instructions. Procedure to online apply of PM SvaNidhi is given below:-

- First, visit the official website of PM SvaNidhi Yojana

- On the home screen, there is an option to apply for a loan

- Click on this link, This will open a page for login

- On this page, the mobile number is needed. Provide mobile number and click on captcha to request OTP

- OTP is sent to your number. Provide this one time password for verification

- After doing this much next page will open. This will show the candidate has a login

- This will open a new page where it is asked work and it has an Aadhar card provide this information application form will open.

- Fill this application form and on the next page upload documents

- Later it is required to submit the application form

- Submitting this application form will initiate the procedure of the loan.

- It will come under scrutiny after verification loan will pass

- Take a printout of this application form for future reference.

Procedure To Apply For Letter Of Recommendation

To get available of PM SvaNidhi scheme applicants have to request for letter of recommendation. This letter is provided to them by following the given procedure:-

- First, visit the official website

- You will see an option to apply for LOR

- Click on this

- Mobile number of candidate will be asked

- An OTP is sent to the number

- Provide this one-time password OTP verification

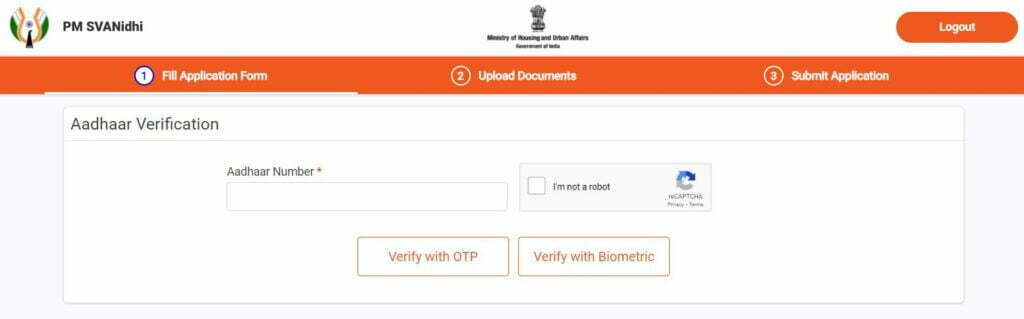

- Details of Aadhar card is required for verification

- Applicant can verify their Aadhar through OTP or biometrics

- After verification upload, documents and press submit

- After scrutiny letter of recommendation will generate for the beneficiary

How To Check Vendor Survey List वेंडर सर्वे लिस्ट देखने का तरीका

An applicant who wants to apply for a loan must check the name in the vendor list. This vendor list will have the survey name of all the applicants and respective areas. The procedure to check the vendor survey list is given below:

- First open official website

- On home page in this section for scheme instruction

- In this tab there is option for vendor server list

- Click on this option

- Details of candidate are asked

- Details are as state, ULB number, vendor ID card, number, certificate of vending number, name of street vendor, father’s name, mobile number

- Provide all the details and search

- If applicant is having name in the list they are eligible for loan

- If they do not have name they can apply for letter of recommendation

- This will help them to get from urban local body

Lenders Of Loan

The government’s micro and macro financing organisation can lend this money. These lending institutions are encouraging to enhance their network of fields. कौन कौन लेंडर है योजना के It is providing business correspondent, agent extensively to increase the coverage of this scheme.

Scheduled commercial banks, regional rural banks, small finance banks, non-Banking Finance Corporation micro-financing SHF etc are working to provide SvaNidhi. As you know that Andhra and Telangana do not have a Micro Finance institution. But they have a strong network of SHG. They are utilising that source to mobilize and generate loans. Other states are using their robust network to provide loans to Street vendors.

Pradhanmantri SvaNidhi Mobile Application

To make this scheme more easy and accessible government has launched a mobile application. मोबाइल एप्लीकेशन डाउनलोड was launched on 17th July. Under mobile application, the interface is made very user-friendly and a list of all the lending Institutions and survey list is provided. Also, the procedure of applying for a loan online is given. Applicants can access mobile applications to get credit digitally.

Frequently Asked Questions

Why this scheme was launched?

Coronavirus lockdown has adversely impacted the business of street vendors. They do not work for a very big amount. But a small capital base business. Due to lockdown, they consumed their capital. Therefore they do not have any credit to start and resume. Therefore in order to support them, this scheme was launched.

What is the lending Institute?

To provide loans, scheduled commercial bank small financial bank Cooperative Bank regional rural bank Microfinance Institution and non-banking financial companies are lending institutions.

How much amount is provided under PM SvaNidhi Yojana?

Working capital up to 10000 is provided for one year to vendors. This amount will increase from the next working capital if paid this loan early.

Can I apply for the loan if I do not have an identity card but my name is on the survey list?

Yes, in that case, you can get a provisional certificate of vending from an IT-based platform. This agent will help you to fill the application form. After uploading documents process will initiate for loan payment.

What KYC documents are required?

With a letter of recommendation, important documents which are required for KYC are Aadhar card driving licence voter ID card MANREGA card pan card.

How much collateral do I have to avail to get this loan?

No Collateral security is needed to get this loan.

What are interest rates and subsidies?

There is a 7% subsidy on the interest rate. This interest subsidy will be directly credited to the account of the beneficiary every quarter. If the applicant has done an early payment of the loan this subsidy will be credited to them at one time. Paying a loan of 10000 in all 12 will provide almost 400 subsidy amount.

Is there any penalty for repayment of the loan after the scheduled time?

Yes, the applicant will be charged a penalty for not paying the loan on time. However, if they have paid the loan before time there is no penalty.

What total time is required to get the loan approved?

This complete procedure is done through the official website and mobile application. After verification and whole processes applicant can get a loan within 30 days.